If you are looking for individual health insurance from the Marketplace – there are four ACA health plan categories for you to choose from: Bronze, Silver, Gold, and Platinum. These categories, sometimes called metal levels, have nothing to do with quality of care, and all to do with how you and your plan share costs.

The plans within each metal level can also differ greatly and vary by premium, deductible, copayments, coinsurance, coverage, and more. Each category may include several types of plans and provider networks, like health maintenance organizations (HMOs) and preferred provider organizations (PPOs).

Difference between ACA metal levels

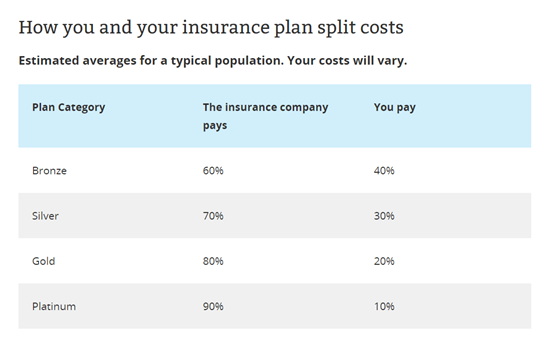

For each plan category, you’ll pay a different percentage of total yearly costs of your care, and your insurance company will pay the rest. Total costs include things like premiums, deductibles, copayments, and coinsurance.

(Estimated averages provided by healthcare.gov)1

Essential benefits and quality of care

For a health insurance plan to be ACA compliant, it must meet a minimum set of requirements. One of those requirements is that all plans, regardless of metal levels, must include 10 essential benefits.

The 10 essential benefits include coverage for:

- Prescription drugs

- Pediatric services: For children, plans include dental, vision, and medical coverage

- Preventive, wellness, and chronic disease management services

- Emergency services

- Hospitalization

- Mental health and addiction services

- Pregnancy, maternity, and newborn care

- Ambulatory services, also known as outpatient care

- Laboratory services

- Rehabilitative and habilitative services and devices

ACA Health Plan: Bronze

An ACA bronze plan typically offers the lowest monthly premium but the highest costs when you need care. Bronze plan deductibles — the amount of medical costs you pay your provider yourself before your insurance plan starts to pay — can be thousands of dollars a year.

A bronze plan might be a good choice if you want a low-cost way to protect yourself from worst-case medical scenarios, like serious sickness or injury. Your monthly premium will be low, but you’ll have to pay for most routine care yourself.

ACA Health Plan: Silver

An ACA silver plan typically offers a moderate monthly premium and moderate costs when you need care. Silver plan deductibles — the amount of medical costs you pay yourself before your insurance plan starts to pay — are usually lower than those of bronze plans.

A silver plan might be a good choice if you are willing to pay a slightly higher monthly premium than bronze to have more of your routine care covered. Also, if you qualify for cost-sharing reduction, you are required to choose a silver plan (more on that later).

Cost-sharing reduction and ACA silver plan

The Affordable Care Act created two types of health insurance subsidies for individual health insurance plans purchased on the Marketplace: premium tax credits and cost-sharing reductions.

If you qualify for a premium tax credit, you aren’t required to choose a specific ACA metal level plan. But, if you qualify for cost-sharing reductions, you must pick and enroll in a silver tier plan.

The cost-sharing reductions work by lowering your “out-of-pocket maximum.” This is the total amount of money you’d have to pay in a year if you used a lot of care. Instead of $5,000, your out-of-pocket maximum for a particular silver plan could be $3,500. Your costs will vary depending on which plan you pick. You’ll know exactly how much you can save on out-of-pocket costs only when you shop for silver plans in the Marketplace.

Open Enrollment runs every year from November 1 – January 15!

ACA Health Plan: Gold

An ACA gold plan typically offers a higher monthly premium but lower costs when you need care. Gold plan deductibles — the amount of medical costs you pay yourself before your plan pays — are usually low.

A gold plan might be a good choice if you are willing to pay more for each month to have more costs covered when you get medical treatment. If you use a lot of care, a gold plan could be a good value.

ACA Health Plan: Platinum

An ACA platinum plan offers the highest monthly premium but the lowest costs when you get care. Platinum plan deductibles — the amount of medical costs you pay yourself before your plan pays — are very low, meaning your plan starts paying its share earlier than the other categories of plans.

A platinum plan might be a good choice if you usually use a lot of care, since nearly all of your costs will be covered outside of your premium payments.

Another option: Catastrophic health insurance plan

Catastrophic health insurance is another plan option, but only if you qualify. It should also be seen as a last resort.

On the surface, a Catastrophic health plan might seem appealing because of the low monthly premiums, but they have very high deductibles. They might be an affordable way to protect yourself from worst-case scenarios, like getting seriously sick or injured. But you pay for most routine medical expenses yourself.

If you qualify to buy a Catastrophic health insurance plan, this option will be included in the quotes you receive as soon as you answer a few basic questions here.

Who can buy a Catastrophic health insurance plan?

You automatically qualify to buy a Catastrophic health plan if you are under the age of 30. However, if you’re 30 or older and want to enroll in a Catastrophic health plan, you must apply for an exemption to qualify. There are two types of exemptions: affordability and hardship.

What do Catastrophic plans cover?

A Catastrophic health insurance plan is better than no health insurance at all. That’s because all Obamacare plans, including Catastrophic insurance plans, at least cover the 10 essential health benefits we talked discussed earlier. They also cover at least 3 primary care visits per year before you’ve met your deductible.

Which ACA metal tier is right for you?

Insurance can seem complicated. Plans in all categories have a wide range of deductibles, copayments/coinsurance, and out-of-pocket maximums.

If you aren’t sure what kind of coverage you need, Woligo’s team of experts is standing by to answer all of your questions. All you have to do is click here.