In 2010, President Barack Obama signed the Patient Protection and Affordable Care Act (ACA) into law, otherwise known as Obamacare. A key provision of the ACA was the creation of the premium tax credit for Marketplace health insurance to help make it more affordable for millions of Americans.

What is the premium tax credit?

The premium tax credit is as its name implies, a tax credit, that helps individuals and families with moderate to low household incomes pay for health insurance purchased through the Health Insurance Marketplace. Specifically, the premium tax credit helps lower your health insurance premium, which is the amount you pay for your health insurance every month.

90% of Marketplace enrollees received an advance premium tax credit

Last year, the Centers for Medicare and Medicaid Services published key findings about consumer participation in the federally facilitated and state-based Marketplaces and their eligibility for the premium tax credit. According to the report:1

- 8 million people enrolled in health insurance Marketplace coverage and paid their initial premium, a 23% increase from the previous year.

- 90% of Marketplace enrollees, or 12.5 million consumers, received an advance premium tax credit.

Do you like saving money?

Learn more about your health insurance options and see if you qualify for the premium tax credit.

How does the premium tax credit work?

When you apply for health insurance through the Marketplace, you will be asked to provide information such as the size of your family and expected household income. If you qualify for a premium tax credit based on your estimate, you can choose how and when you receive your tax credit. There are two options.

Option 1: Advance premium tax credit (APTC)

You can choose to have all, some, or none of your estimated tax credit paid in advance to your insurance company. Since the advance premium tax credit is automatically applied to your premium, you pay less out of pocket every month.

Option 2: Tax return

If you don’t want an advance premium tax credit, you can claim the tax credit when you file your tax return for the year. Your premium tax credit can either lower the amount of taxes owed or increase your refund.

It’s important to note that the amount of your premium tax credit is based on your expected household income for the year you want coverage. For example, if you are enrolling in health insurance coverage for 2024, your premium tax credit will be based on what you think your household income will be for all of 2024.

How much is the premium tax credit?

The amount of your premium tax credit is based on a sliding scale. Those with a lower income get a larger credit to help cover the cost of their health insurance premium. In addition to income, other factors that affect the credit amount include:

- Cost of available insurance coverage

- Where you live

- Your address

- Your family size

Woligo insurance pros can help determine your eligibility for the premium tax credit.

Who qualifies for the premium tax credit?

The premium tax credit is available to individuals and families with incomes at or above the federal poverty level and who do not have the opportunity to get affordable coverage through an eligible employer-sponsored plan.

In addition, an individual must be a United States citizen or reside in the United States legally; cannot have filed a tax return with the status of Married Filing Separately; cannot be claimed as a dependent by another person; and cannot be eligible for coverage through a government program, like Medicaid, Medicare, CHIP or TRICARE.

How is household income defined for the premium tax credit?

For the purposes of the premium tax credit, household income is defined as the Modified Adjusted Gross Income (MAGI) of the taxpayer, spouse, and dependents. The MAGI calculation includes income sources such as wages, salary, foreign income, interest, dividends, and Social Security.2

How is family defined for the premium tax credit?

For purposes of the premium tax credit, your “family” consists of yourself, your spouse if filing jointly, and all other individuals whom you claim as dependents. Your “family size” is the number of individuals in your “family.”3

Premium tax credit income limits

The government wants to make sure the premium tax credit goes to people who really need it. So, they set some income limits or rules about how much money you can make to qualify for the credit. If you earn too much, you won’t get the credit.

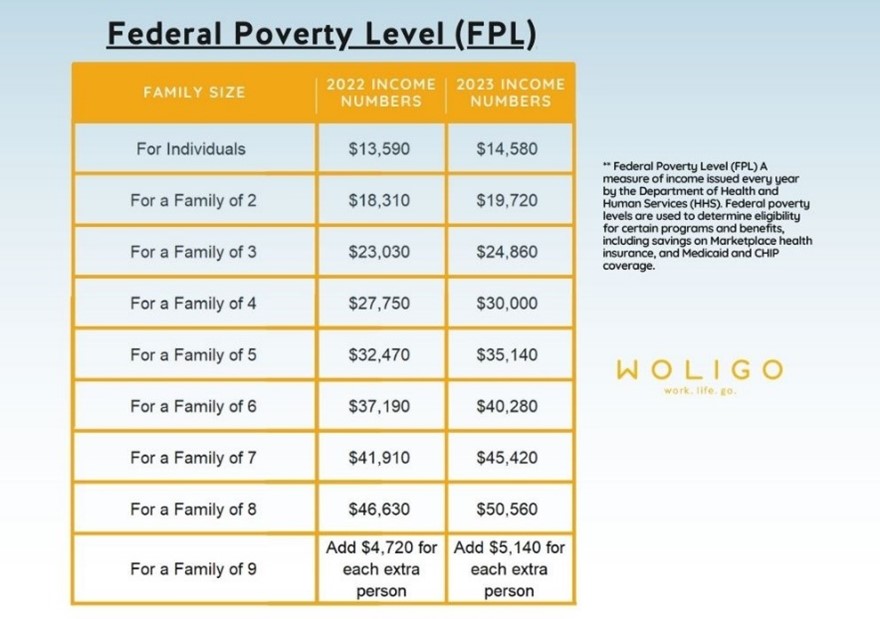

Premium tax credit income limits are based on the federal poverty level (FPL), an amount set by the U.S. government to indicate the least amount of income a person or family needs to meet their basic needs. Many federal agencies use the federal poverty level to determine eligibility for federal programs and benefits, like the premium tax credit.4

When it comes to the premium tax credit, your household income must be at least 100% of the federal poverty line, but no more than 400%. In 2023, that means a family of four must make at least $30,000, but no more than $120,000, to be eligible for the premium tax credit.

(Data courtesy of HealthCare.gov 5)

However, the American Rescue Plan of 2021, also called the COVID-19 Stimulus Package, temporarily eliminated the 400% threshold, and the Inflation Reduction Act extended that provision through 2025. For now, the premium tax credit is available even if your household income exceeds 400% of the federal poverty level, so long as all other eligibility requirements are met.

Why must household income be at least 100% of the federal poverty level?

If you make too much money, you won’t get the premium tax credit. But if you make too little money, you might not get the premium tax credit either. Household income must be at least 100% of the federal poverty level; otherwise, eligibility would overlap with other federal programs. If someone is eligible for another federal program, such as Medicare, Medicaid, or the Children’s Health Insurance Program, they are not eligible for the premium tax credit.

In fact, if you live in a state that has expanded eligibility for Medicaid, the premium tax credit income limits start above 138% of the federal poverty level because that is where Medicaid ends.6

Note: Meeting the income requirements does not mean you’re eligible for the premium tax credit. You must also meet the other eligibility criteria.

What happens if my income, family size, or other circumstances change during the year?

Changes to your household income or family size can increase or decrease the amount of your premium tax credit. For example, Emily the Entrepreneur called the Woligo insurance pros to find the best health insurance coverage for her needs. During enrollment, Emily estimated her total household income would be $40,000 and opted for the advance premium tax credit.

That same year, Emily grows her business and increases her income (yay!) but doesn’t realize that an increase in her household income could lower the actual amount of her premium tax credit (booo!) because she is now earning more. If Emily doesn’t call Woligo right away to update her household income and adjust her advance tax credit payments, she might find out she has to repay some of that tax credit when she files her federal tax returns.

If you experience changes to your household income or family size, call your Woligo insurance pro as soon as possible. They can adjust the amount of your premium tax credit and help you avoid a surprise bill come tax time.

How does the health care tax credit affect my tax return?

Since the premium tax credit is an estimate based on your expected household income, you are required to file IRS Form 8962 with your federal tax return. Form 8962 reconciles the premium tax credit by comparing the amount you received with the actual amount you are eligible for based on your final household income and family size.

If you underestimated your household income during open enrollment, you may have received too big of a premium tax credit and have to pay some of it back. On the other hand, if you overestimated your household income, you may be owed a bigger tax credit, which you can claim as a refund when you file your federal taxes.

Even if you estimated your income perfectly, you are still required to complete IRS Form 8962 and submit it with your federal tax return. If you don’t file Form 8962, the IRS will call this a failure to reconcile, and you may not be able to apply for Marketplace premium tax credits in the future.

Do you like saving money?

Woligo insurance pros have helped thousands of people, just like you, apply for the premium tax credit and find the right health insurance coverage to fit their individual needs.

Sources:

- https://www.cms.gov/files/document/early-2022-and-full-year-2021-effectuated-enrollment-report.pdf

- https://www.kff.org/health-reform/issue-brief/explaining-health-care-reform-questions-about-health-insurance-subsidies/

- https://www.irs.gov/affordable-care-act/individuals-and-families/questions-and-answers-on-the-premium-tax-credit

- https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines/frequently-asked-questions-related-poverty-guidelines-poverty

- https://www.healthcare.gov/glossary/federal-poverty-level-fpl/

- https://www.healthinsurance.org/glossary/federal-poverty-level/