Affordable health insurance under the ACA

The Patient Protection and Affordable Care Act (ACA), also known as Obamacare — became law in March 2010 and is widely regarded as the most comprehensive reform of health care in the United States. The law had three primary goals: 1

- Make affordable health insurance available to more people.

- Expand the Medicaid program to cover all adults with income below 138% of the federal poverty level. (Not all states have expanded their Medicaid programs.)

- Support innovative medical care delivery methods designed to lower the costs of health care generally.

It is not uncommon for legislation, especially large pieces of legislation, to contain flaws, mistakes or lead to outcomes that writers and sponsors of the legislation never intended to create. And unfortunately, the ACA, which encompasses nearly 11,000 pages of regulations, is no exception.

This article dives into an issue found within the first goal of the ACA: to give more people access to affordable health insurance. While the ACA absolutely did accomplish this goal, it simultaneously created an exclusion that has been deemed the family glitch loophole.

Ready to find your perfect plan?

Answer a few questions to have your custom quotes emailed directly to your inbox!

SEE MY PLANS >

Employer requirement for affordable health insurance

In an effort to make health insurance more affordable, the ACA began requiring employers with at least 50 full-time employees to provide their employees with a health plan that is affordable for them. “Affordable” health insurance coverage, according to Healthcare.gov, means that the cost to the employee cannot exceed 9.12% of the employee’s monthly total household income.2

Sounds great, right?

It would be great – if that percentage counted toward coverage for an entire household. Unfortunately, the affordability requirement under the Affordable Care Act ONLY applies to the employee. One person. No matter how many people are in that household, no matter how many dependents that employee has to provide for.

Suppose that one employee has a spouse and three children. The cost of covering the entire family comes to $2,500 a month — 40% of the gross household income. As it stands, this is still considered “affordable” health coverage as long as the employee’s own premium is less than the 9.12% threshold. The family members, those who are not directly covered under the affordability provision, are those that fall into the family glitch loophole.

And the worst part – because the employee has “affordable” coverage through their employee, no one else in the household is eligible for financial assistance from the government.

Eligibility for premium tax credits

If someone does not have access to “affordable” health insurance coverage through an employer, then they may be eligible for subsidies created by the Affordable Care Act, also known as premium tax credits. These tax credits help make monthly health insurance premiums more affordable for households that don’t qualify for public programs but have incomes that are 100% – 400% of the federal poverty level (FPL).

For tax years 2021 and 2022, the American Rescue Plan 3 of 2021 temporarily expanded eligibility for the premium tax credit by eliminating the rule that a taxpayer is not allowed a premium tax credit if his or her households income is above 400% of the federal poverty level.

Under the current rules of the Affordable Care Act, the affordability requirement only applies to the employee – not their dependents. So, as long as a working mom has affordable health insurance coverage for herself through her employer, it doesn’t matter that adding her children to the employer sponsored health insurance would make it unaffordable. She can’t qualify for premium tax subsidies to afford coverage for her family.

Millions impacted by family glitch exemption

According to the Kaiser Family Foundation, more than 5.1 million are impacted by the ACA family glitch loophole. Out of those who fall in the glitch: 4

- Approximately 2.8 million are children under the age of 18

- They are more likely to be female (54%) than male (46%)

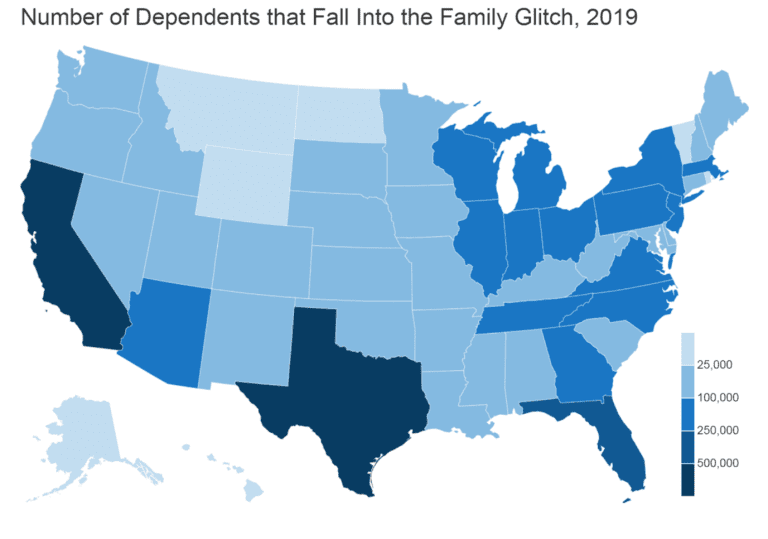

(Figure courtesy of the Kaiser Family Foundation.)

As you can see from the above figure, the states with the largest number of people falling into the family glitch loophole are Texas (671,000), California (593,000), Florida (269,000), and Georgia (206,000). 5

Failed legislative efforts to eliminate family glitch loophole

There have been several attempts over the years to fix the family glitch loophole through legislation, but none have been successful. 6

In 2014, then-Senator Al Franken introduced the Family Coverage Act, which would have adjusted the law so that the affordability test would be applied to the entire premium that a worker must pay for family coverage, not just employee-only coverage. The bill never progressed beyond committees though, and lawmakers seemed hesitant to fix the family glitch, given the additional burden it would place on the taxpayer-funded subsidy program.

Hilary Clinton also vowed to fix the family glitch loophole during her 2016 presidential campaign but ultimately lost the election.

Ready to find your perfect plan?

Answer a few questions to have your custom quotes emailed directly to your inbox!

SEE MY PLANS >

President Biden moves to fix family glitch

In April of 2022, President Joe Biden filed an executive order directing federal agencies to continue doing everything in their power to expand affordable, quality health coverage. This includes: 7

- Making it easier for people to enroll in and keep their coverage.

- Helping people better understand their coverage options so they can pick the best one for them.

- Strengthening and improving the generosity of benefits and improving access to health care providers.

- Improving the comprehensiveness of coverage and protecting Americans from low-quality coverage.

- Continuing to make health coverage more accessible and affordable by expanding eligibility and lowering costs for Americans with ACA, Medicare, or Medicaid coverage.

- Connecting people to health care services by improving access to health care providers and linkages between the health care system and communities to help Americans with health-related needs.

- Taking steps to help reduce the burden of medical debt that far too many Americans experience.

Family glitch proposed rule

As a result, the Internal Revenue Service (IRS) and the United States Department of Treasury filed a joint Notice of Proposed Rulemaking that would expand who is eligible for a premium tax subsidy. Specifically, the proposed changes under section 36B of the Internal Revenue Code (the “Code”) would:

- Amend the existing regulations regarding eligibility for the premium tax credit (“PTC”) to provide that affordability of employer-sponsored minimum essential coverage (employer coverage) for family members of an employee is determined based on the employee’s share of the cost of covering the employee and those family members, not the cost of covering only the employee.

- Add a minimum value rule for family members of employees based on the benefits provided to the family members.

- Affect taxpayers who enroll, or enroll a family member, in individual health insurance coverage through a Health Insurance Exchange (“Exchange”) and who may be allowed a PTC for the coverage.

Impact of the family glitch fix

If the fix is successful, it’s hard to say exactly who will benefit and by how much because the cost of comprehensive health coverage can vary from state to state and the plan that is chosen. However, what we do know is that health insurance will be more affordable for nearly five million Americans, and it’s estimated that 200,000 uninsured people would gain coverage.

Supporters and opponents of the family glitch fix

The American Hospital Association, the American Medical Association and the American Academy of Family Physicians are just a few of the many supporters of this fix for the family glitch loophole.

Dr. Gerald E. Harmon, president of the American Medical Association, said the Biden Administration “has taken a crucial step in the campaign to cover the five million uninsured people who fall into the family glitch. The family glitch is inconsistent with the goals of the Affordable Care Act and unfairly penalizes family members of lower-income workers.” 8

Some supporters of fixing the family glitch loophole are against the fix being accomplished through the administrative rulemaking process because the rule can just be undone by a future administration. But the good news is that some of the people currently caught by the family glitch loophole could have more affordable coverage options as soon as 2023.

Woligo continues to monitor the situation and will have licensed agents ready to assist families with enrolling their loved ones if the administrative rule is finalized.

For additional information on Obamacare and medical insurance, see our Ultimate Guide to Obamacare for Small Business Owners and Ultimate Guide to Health Insurance Terms.

Call us now at 888-633-5229 or get a no obligation quote by clicking here. Open enrollment for individual health insurance is from November 1st to January 15th – so don’t delay!

Sources:

- https://www.hhs.gov/healthcare/about-the-aca/index.html

- https://www.healthcare.gov/glossary/affordable-coverage/

- https://www.irs.gov/affordable-care-act/individuals-and-families/eligibility-for-the-premium-tax-credit

- https://www.kff.org/health-reform/issue-brief/the-aca-family-glitch-and-affordability-of-employer-coverage/#:~:text=In%20total%2C%20we%20find%20more,through%20employer%2Dsponsored%20health%20insurance.

- https://www.kff.org/health-reform/issue-brief/the-aca-family-glitch-and-affordability-of-employer-coverage/

- https://www.forbes.com/sites/theapothecary/2021/05/13/the-family-glitch-administrative-fix-under-consideration-by-the-biden-administration-remains-both-illegal-and-harmful/?sh=4b8b53c366aa

- https://www.whitehouse.gov/briefing-room/statements-releases/2022/04/05/fact-sheet-biden-harris-administration-proposes-rule-to-fix-family-glitch-and-lower-health-care-costs/

- American Medical Association